1040 vs 1099 - What's the Difference?

Preparing your taxes is typically tedious since it includes the use of several forms and they all have various uses.

Depending on a person’s specific job, they tend to compete and submit a few different forms.

1040 and 1099’s are the most common forms especially for freelancers and independent contractors.

In this article, we’re going to explore 1040’s and 1099’s, their uses and the difference between these forms.

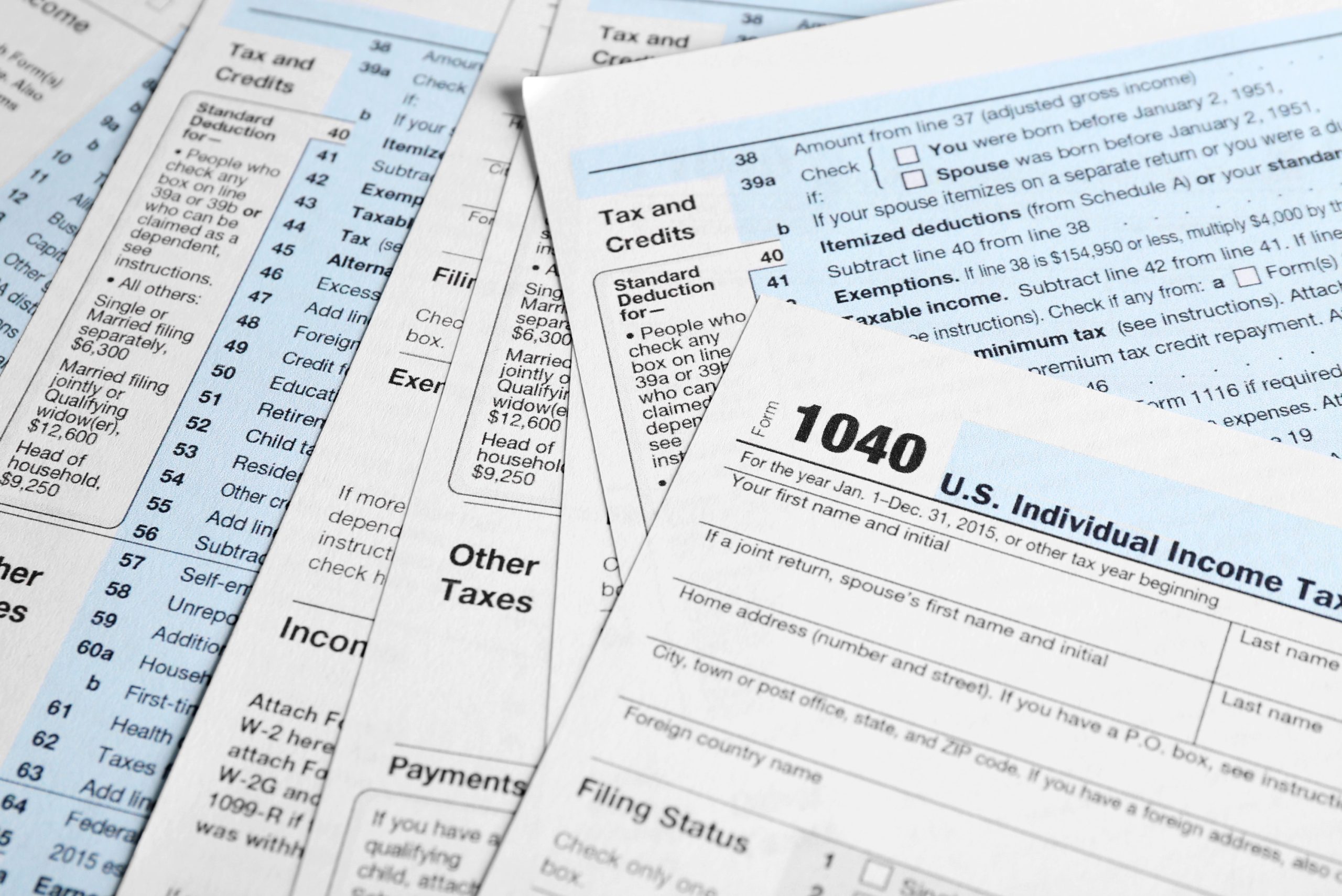

What is a Form 1040?

A 1040 is a primary tax form which most people who are self-employed use to report their income. The 1040 is particularly important because it is fundamentally your master sheet and it offers information that all the other tax forms and taxpayers may fill out.

For instance, if a taxpayer has multiple jobs and must submit a 1099 and W-2, both these forms can appear on their particular 1040 form.

If a taxpayer for instance has multiple jobs and has to submit a 1099 and W-2 both of these can appear on the 1040.

The 1040 has several key sections and it is used to guide taxpayers through calculating their income and returns.

What are the Parts of 1040 Form?

Lines 1 – 9

These show the types of income a taxpayer receives. These include investments and miscellaneous earnings too.

Lines 10a and 10b

This next section of lines include specialized deductions which would then show adjustments to your gross pay. These examples can include student loan interest or charity donations.

Line 12 and 13

This is the place where tax payers subtract standard or itemized deductions. These can include business income or adjusted gross income to find the total amount which is taxable.

Line 16 – 24

The next 8 lines are calculations which determine the total amount a taxpayer owes for their income.

Line 25 – 33

The final section subtracts tax credits from tax owed. This then results in the final amount owed or a refund.

1040 vs 1099 – How these forms differ

One of the most prominent ways in which 1040 differs from 1099 is the number of types they have.

A 1040 form can show the information from all the tax forms a taxpayer culls. There is, however only one type of 1040 form.

This means that people who come from various income sources submit the same 1040 form while the information on this form is what will differ.

There are however various types of 1099 forms that people can use to report non-employment income. And these include a specific type of service which allows a person to earn money and therefore declare taxes.

The Types of 1099’s

1099-DIV

This is used to report dividend income.

1099-NEC

This form allows tax payers to report any income they have earned working as an independent contractor, freelancer or self-employed.

1099-INT

This is for taxable interest income.

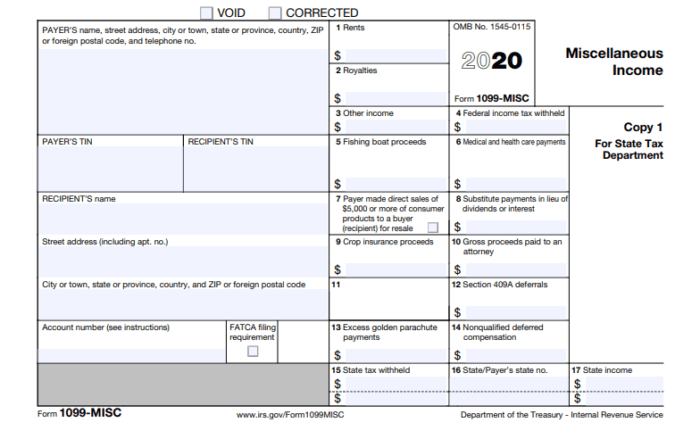

1099-MISC

This is one of the most common Form 1099's out there. This is used to report miscellaneous income such as rents, health care payments, or awards.

Which People Typically File Form 1040 vs Form 1099?

It's a given that almost all people are required to file a form 1040.

1040 is the primary form which shows the types of income a person has and where these sources come from.

1040 is important to show how much in taxes are owed and it is also a form 1040 which shows any tax refunds person can earn.

1099's are filed for independent contractors or freelancers if their income exceeds $600 any given year.

How we Can Help

Tracking your income ensures that you can file your 1040's much faster. Download the Form 1040 link from the IRS.

And if you only need a 1099, we have 1099's for you.

Generating pay stubs is the fastest way to keep track of your income.

Stay on top of taxes through creating your own pay stubs.