WHAT DOES A PAY STUB LOOK LIKE?

What Information is on a Pay Stub?

Pay stubs are often used for tax filing purposes for both employees and employers.

They contain vital information pertaining to salary, work hours, and government remittances

A pay stub can be kept for tax records for up to seven years from the date of payment.

Pay stubs must also be provided to employers by employees at their request.

These are some of the information that your pay stub should contain:

- Your employer's company name

- Your employer's address

- Your name

- Your employee number or the last four digits of your social security number

- Pay period covered

- Gross earnings

- Deductions

- Net earnings

If you’re self-employed, you can use an online paystub generator to prove your income.

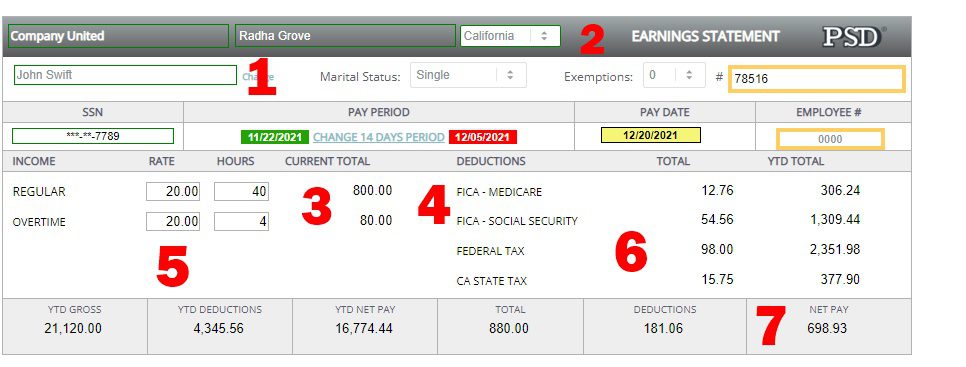

What A Pay Stub Looks Like

A pay stub, simply put, looks like a check! In fact, pay stubs are check stubs!

We'll go through some of the fundamental parts of a paystub so that you can be oriented on trying out our online paystub generator.

If you look at the picture on top, they don't include all portions of a paystub.

If you get the hang of it though, filling in your check stubs will be easy and fun regardless of whether you're self-employed, or an employee looking out to fill a stub for contractual work done.

Section 1 - Full Name of Employee

Remember to put your full name or the full name of the recipient of these payments on the check stub.

Double-check for spelling and any name extensions or titles.

Section 2 - Your State

Your state is very important.

In fact, it is the one thing that affects the other dynamic values in a paystub.

Since income tax rates vary per state, it's important to be accurate about choosing the state you reside in.

With your paystub, you won't have to worry about making individual calculations.

Section 3 - Your Employees' Salary and Work Hours

The sum total of these will be called the Gross Pay.

Enter the information accurately.

Time tracking and making sure you only pay for hours worked are crucial.

Using online paystubs allows you full control of monitoring your employee's productivity through inputting their salary and work hours.

Section 4 - Deductions

These include Federal Taxes and Social Security.

Depending on the state you live in, the remittances will vary.

This part of a pay stub will allow your employees to double-check the information and remittances for transparency.

If you're self-employed? You can use these to properly depict an accurate view of your taxes and government payments.

Section 5 - YTD Deductions

A notation for "year-to-date deductions" or "YTD deductions" on a pay stub o generally refers to any money deducted from the earner's income or payments since the beginning of the current calendar year.

Year to date is important in showing performance and an employee's progress over time.

Or the progress of your income if you're an entrepreneur using these check stubs.

Section 6 - Total Deductions

This is the amount which will be remitted based on your state and healthcare taxes.

From this amount you will be getting your net pay.

Section 7 - Net Pay

This is an employee's take home pay or their Net Pay.

Their net pay depends on all the other calculations mentioned above and it can vary from state to state or depending on hours worked.

We recommend checking local state laws and mandates to stay compliant.

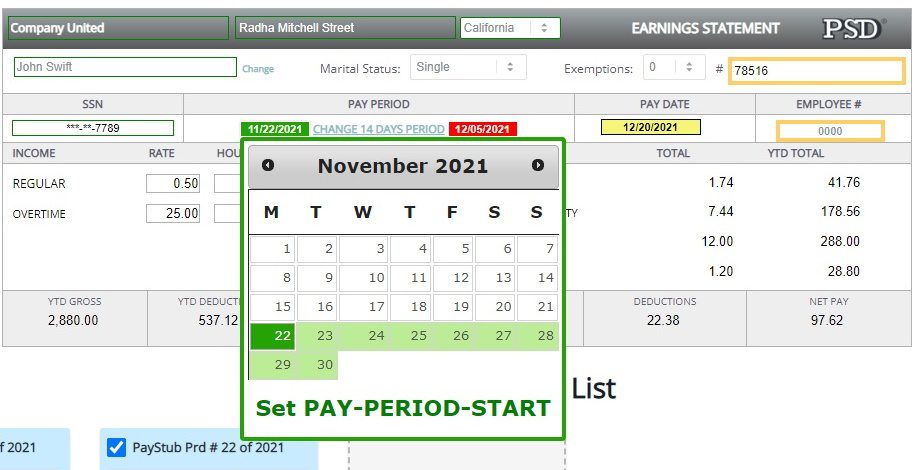

Section 8 - Pay Periods on a Pay Stub

While we didn't include this next section in the main list above, pay periods are equally if not more important to take note of.

Ideally, you would want to choose pay periods which allow you to catch up with the rest of the payroll cycle.

You don't want to keep shelling out cash too often and at the same time you don't want your employees to wait too long if your workers are contractual instead of salaried employees.

For that reason, our paystubs feature 4 options for payment periods, weekly, 2 weeks, monthly, and bi-monthly.

Choosing the one which fits your schedule and your time gives you a lot of freedom to work with your staff and make sure that all of them are being happy because they don't miss out on a single pay check stub you have.