What does YTD Mean on a Pay Stub?

Year-to-date (YTD) simply put, is the amount of money and total spending your company has had on payroll at the start of each calendar year. And it ends on the current payroll date.

If you are an employer, calculating your Year to Date pay is going to be inevitable in your paychecks. And it certainly is something which affects you if you are the earner or the employee.

Importance of Understanding YTD on Paystub

YTD on your paystubs isn’t just used for yearly earnings. But it can also track savings and help in future spending. YTD, in other words can help track an employee’s progress in terms of income.

It’s equally useful for hourly or salaried workers on whether they should put in extra hours or not.

Furthermore, YTD is one of the calculations involved in paycheck taxes.

Different Ways YTD is Used

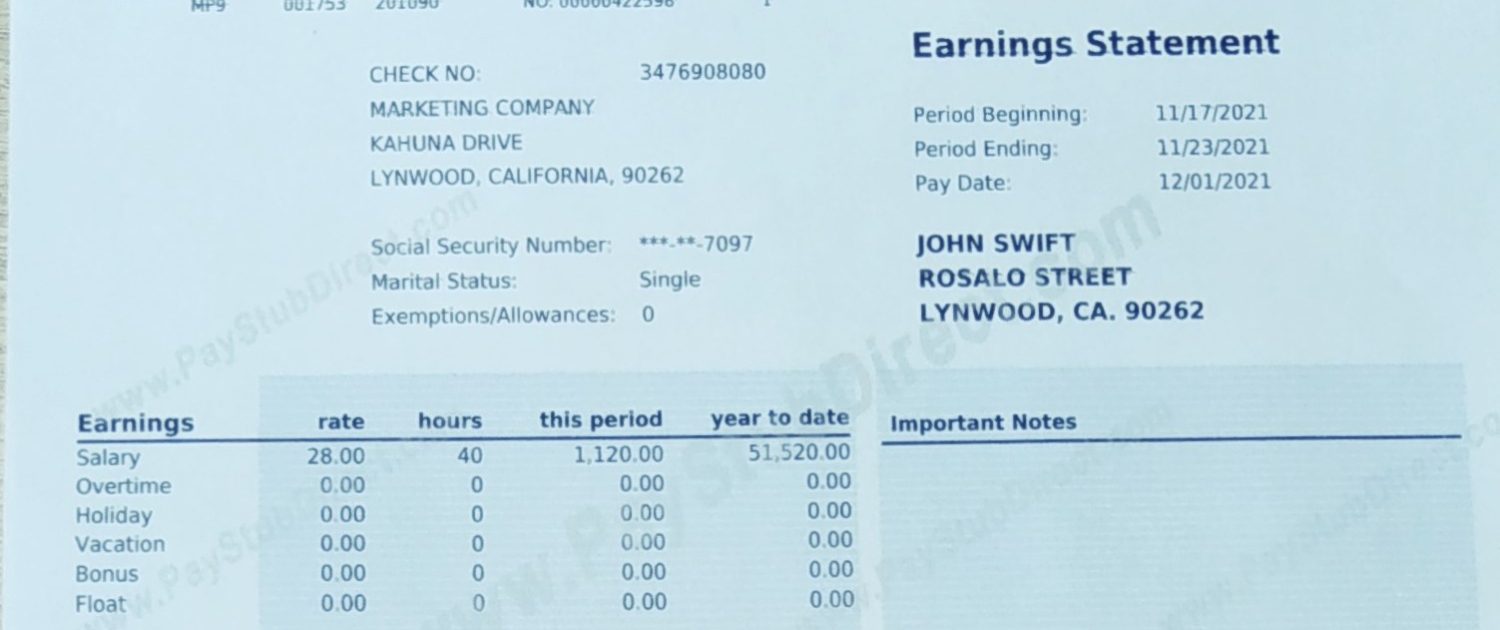

YTD Gross

Year-to-Date Gross is money that has been paid to you from your company the year before deductions. YTD Gross is a summary of gross wages, bonuses, and commissions.

YTD Net Pay

Total amount your have received for that given year after taxes and deductions are removed.

It’s important to note that YTD Gross doesn't include things such as bonuses unless they are reported by the company as part of your earnings. On the other hand, YTD Net Pay. does include those items in addition to what Gross Year-to-Date includes.

YTD Deductions

These are specific components of your deduction which result in your net pay. IT can include pension or 401k, your medicare and other benefits a company confers on an employee.

YTD Specifics on Medicare Payments

Sometimes, an additional 1.45% of wages is taken out by employers in order to fund Medicare benefits for retirees who have reached 65 years old. This amount doesn't need to be matched by the employee which means that employers pay 100 percent of this fee on their own behalf while employees do not contribute any money towards their own Medicare benefits when they retire after reaching 65 years old.

Put Understanding to Work

Calculate YTD Manually

If you want to calculate year-to-date for your employees manually, you have to multiple their gross income pay periods by how many paychecks you’ve given them.

If you have employed a personal assistant or driver for example and they’ve worked for you for 14 periods, and they’ve earned $2500 per pay period - Multiply that amount by the number of payments you’ve given them across a given year.

Calculate YTD with a Pay Stub Generator

To make things faster, you can calculate your year-to-date amounts through the use of an online pay stub generator! Several states have requirements on whether you print the pay stubs or not. You should review these laws here and cross-check them with any changes to local statutes.

Generate a paystub, fill in their information and calculate their gross earnings and deductions, it will include YTD and calculations are fast and easy!