How To File Taxes With Last Pay Stub

Tax season can be very daunting and sometimes its stress can take a toll on you.

But staying familiar with and getting a knack for filing your taxes and deductions can eventually become muscle memory.

Your W-2 form usually contains most of the information including your gross and net income and the deductions that go with it.

However, there are times when employers can’t produce the W-2.

This is when paystubs come in handy.

This article will get into how to file taxes with your last pay stub.

Can you File your Taxes using your Pay Stub?

Yes, in fact, if you’re a freelancer or self-employed, you’re encouraged to record your income through the use of pay stubs.

The information on your paystubs will help you learn how much to deduct from your gross pay.

If you want to learn how to file taxes with your last pay stub, then follow these steps and you’re on your way to declaring your year’s income taxes.

How to File Taxes with your Last Pay Stub

1. File your Taxes Online

This is the most ideal way to file taxes based on your last paystub.

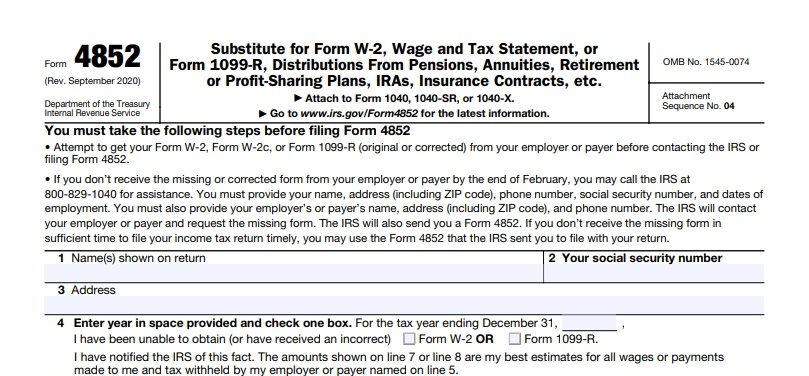

The first thing you need to do is go to the IRS website and fill out Form 4852.

Form 4852 is done if your employer has failed to file your W-2 or if your previous W-2 is erroneous.

Like we discussed here, you cannot use 4852 if your W2 is simply misplaced.

The IRS has a cut-off for people wanting to file their taxes electronically.

You have to be earning less than $73, 000 to take advantage of the online filing of taxes.

If your income is higher than that, then you may need to file your taxes by printing them and sending them via snail mail.

You can also only file electronically if you’re above the age of 16 and you’ve previously filed income taxes too.

2. You need your Employer’s Identification Number

The EIN – Employer Identification is paramount if you want to file taxes from your last pay stub.

Your last check stub will have cumulative earnings and deductions from the previous tax year.

However, you will need the EIN so that it’s processing will be much faster.

3. Form 4852

The information you will be needing in form 4852 is your full name and address.

You will also need to fill in your social security number.

This is not an official tax filing document.

And it’s likely you will need to explain your reasons for using Form 4852.

4. Paystub Information on your Form 4852

You need to start filling out your form 4852.

Use the bottom half of the form because the top half is for those who have W-2’s but have filled them out erroneously or need to make changes.

And the bottom is for those who usually get form 1099-R. So you shouldn’t fill out this one again if you misplaced your W2.

It only qualifies if your employer has failed to produce one and you’ve already contacted them for alternatives.

Wages, tips, and other earnings

- Medicare wages

- Social security wages

- Social security tips

- Federal income tax

- State taxes

- Social security taxes

- Medicare taxes

After you’ve made your computations, you’ll be tasked with explaining on how you got to those amounts.

Then you can certify your information by saying that they were “The sum total of amounts obtained from the final pay stub (of your tax year).”

You must also provide additional information about how you made efforts to retrieve your W-2 form from your employer.

After you’ve signed it, you will need to print it and mail it also.

How PaystubDirect can Help You

If you want to make sure the amounts you calculate are correct, you will need a tax calculator. This is where we can help you out.

Our pay stub generators are also tax calculators and the figures are automated and dynamic based on the State you choose!

So make sure to fill out your pay stub correctly and start calculating your taxes for the previous year.

Follow the guidelines you learned in this article and reporting your taxes won't have to be such a chore.