What is Form 1099-NEC and who has to File it

What is Form 1099-NEC?

1099-NEC is the new way to report self-employment income instead of Form 1099-NEC which was the traditional form being used.

This is done to clarify separate filings and the 1099-NEC form has been used starting with 2020's tax year.

Small business owners need to use this form if they have made payments of $600 or upwards to a non-employee.

Non-employees include people such as independent contractors.

If you are self-employed, you may request this form from a business that has paid you $600 for your services.

And you ought to receive these forms on January 31st or the following business day if it falls on a holiday.

What types of Compensation are in Form 1099-NEC?

Prior to its reuse in 2020, 1099-NEC was used in 1982, from that point on until 2020, most businesses file Form 1099-MISC to report payments totaling $600 or more to a non-employee for their transactions.

1099-MISC typically represents non-employment compensation such as contractors, but since there was some confusion on reporting what types of payments, 1099-NEC was used to facilitate faster submissions for those who use the form.

What is non-employee compensation?

The IRS has revealed that in general, you must report payments that meet the following criteria.

1. The payment is made for a non-employee.

2. The payments are made in the course of your trade or business.

3. The payments are made to an individual, partnership, estate, or corporation.

4. The payment total reaches $600 or more for a given year.

Small businesses must also file Form 1099-NEC

if they pay an individual at least $10 in royalties

if the business has withheld any federal income tax under backup withholding rules regardless of the number of payments.

Non-employee compensation can generally include:

- Fees

- Benefits

- Commissions

- Prizes and awards for the services performed by a non-employee

Other forms of compensation for those who are not your employee.

Nonemployee compensation can include:

- Fees

- Benefits

Commissions

Prizes and awards for services performed by a nonemployee

Other forms of compensation for services performed for your trade or business by an individual who is not your employee

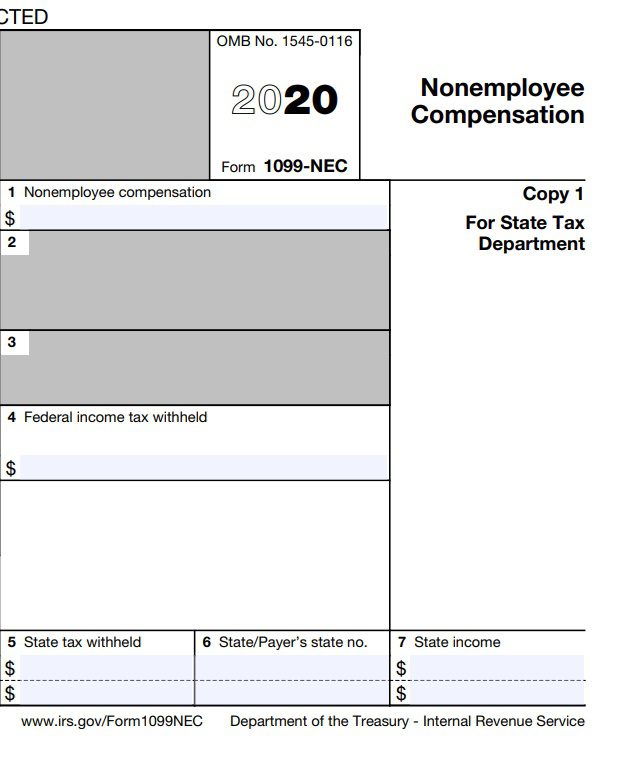

How to Fill In 1099-NEC?

Self-employed people should not have to report personal payments on the year of the form. Yet the form would only relate to payments as it connects to a business you have worked for.

The first box for example is generally reported as self-employment income and subject to self-employment tax.

Payments to individuals who are not reportable on 1099-NEC are then reported on the 1099-MISC.

Here are a couple of examples:

Commissions paid to nonemployee salespeople that are subject to repayment but not repaid in the given year.

Professional services such as fees to attorneys, including corporations, accountants, architects, and contractors

Fees paid by one professional to another such as cuts and referral fees.

Payments of attorneys to witnesses or consultants

Payments for services including payments for parts or materials used to perform the services.

Any business which makes nonemployee compensation up to $600 or more which has at least 1 contractor and withholds federal income tax will now use this form. It is from January 31st and there are no 30-day extensions unless the business meets certain hardship conditions.

How can I tell 1099-NEC from 1099-MISC?

Since the IRS has removed the non-employee compensation from 1099-MISC, the IRS has also made changes to that form.

The huge adjustment to the form of 1099-MISC is Box 7, and instead of non-employee compensation, it now reports direct sales.

Other information on 1099-MISC is now reported in renumbered boxes.

How we can Help

You can start by tracking your income with the use of pay stubs.

Create a pay stub now and start tracking your income.