How to Calculate W2 Wages From Paystub

It’s January again! And it’s usually income tax returns filing season time.

Most people cram and they usually don’t get their taxes started until they have a W-2 in hand.

This article will help you learn how to calculate W2 wages from a paystub.

Most of the information you need for filing W-2 is already on your pay stub.

You can easily track this information if you’ve been proving your income through the use of pay stubs.

Difference between W-2 and a Pay Stub

If you haven’t kept track of pay stubs or payroll then it’s understandable you may confuse your check subs for a W-2 form.

Of course, you may also find some confusion when your pay stub earnings are not exactly the same as in your W2.

So here are some key points.

What is a Paystub?

Your paystub or check stub is a paycheck you receive every pay period from your employees.

Your pay stub can also include some deductions. And after these deductions, you will then get your net pay, these are your take-home earnings.

Recommended Reading: What is a pay stub?

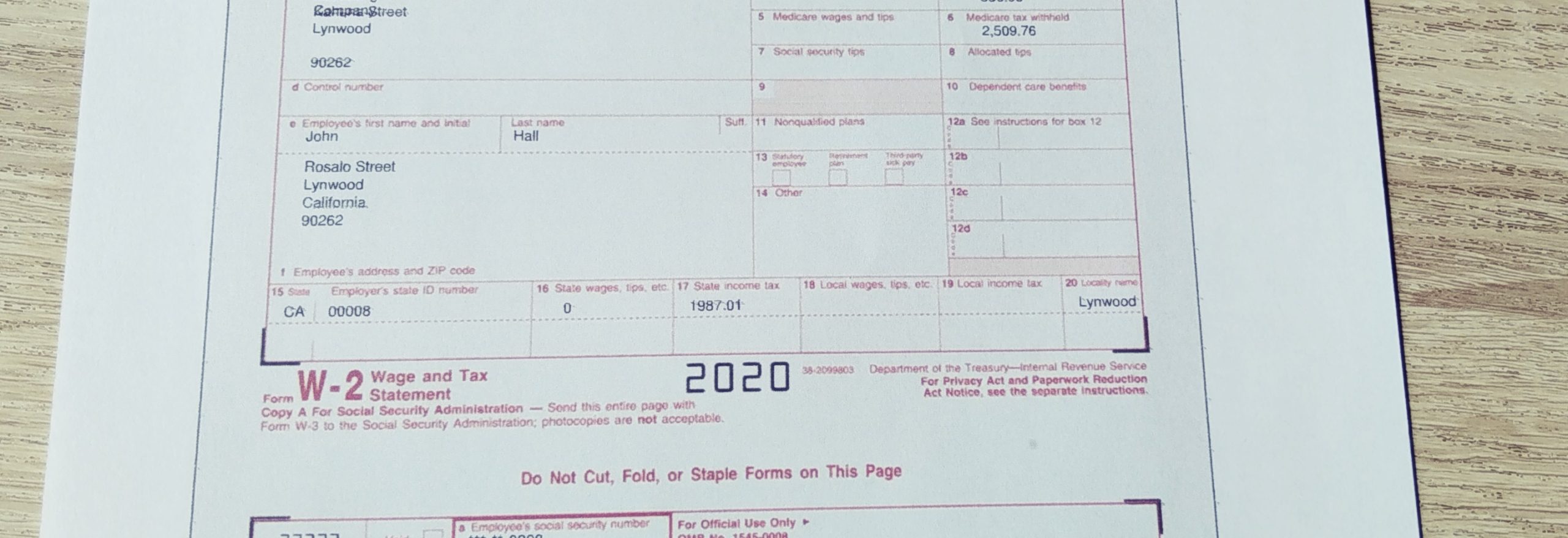

What is a W-2?

W-2 is a tax form that will show the sum total of all of the taxes which have been withheld from your paychecks for the past year.

These include state and federal taxes and this is a vital part for employees to file income tax returns.

You may also learn more about W-2s on the IRS website.

Calculate W-2 Wages from a Pay Stub

W-2 sufficiently tells you about how much taxes have been taken from you.

But sometimes, you may not be waiting around your W-2 all the time.

So it’s quite possible to calculate your W-2’s manually using your check stubs.

Paystubs may not reflect the information verbatim on W2’s but it generally contains everything you need to know.

1. Calculate your gross income

This is the first time. Your gross pay is all the money you’re making before taxes.

Most employees earn an hourly rate and they work for a certain number of hours in a given week.

Pay stubs generally show the amount you make and they will also include any overtime tips, bonuses, and commissions.

2. Take a look at other Deductions

There are many people who may have pretax deductions which lower the amount of taxes they have to pay.

Some of these include employer benefits and health insurance.

Life insurance, transportation packages, and others.

Subtract this amount from the number you’ve had in the previous step.

This is then the foundation of your W2 which is your total taxable income for the year.

Also Read: Payroll Deductions

3. Eliminate your Non-Taxable Income

Subtracting your nontaxable income is paramount.

There are parts of your earnings in a pay stub that do not necessarily include state and federal taxes.

So it’s important to get the sum total of these and subtract it from your gross income also.

Examples of nontaxable income are:

- Health insurance

- Gifts

- Income from a corporate partnership

- Dental and life insurance or eye care

- Child support payments

- Reimbursement cash for your dependents

4. Calculate your Yearly Taxes

You should find the amount of your local, state, and income taxes on the paystub which are then remitted from your earnings.

The next step is you multiply these by the number of pay periods you have.

If you get paid twice monthly, you’re going to use 24 as your number and the sum total of these will be the taxes withheld for your earnings.

5. Calculate your Total W-2 Earnings

After all those steps above, you may subtract the total taxes from your gross income from the number you got from your pretax deductions and your other remittances.

The sum of these is your net come for the year.

6. Stay on top of tax season – Calculate your W-2 Wages from a Pay Stub

It’s not a good idea to keep waiting around until January to start backtracking and calculating your W2s.

Every time you earn, you can calculate the income from your paystub.

If the numbers on your pay stub and your W2 don’t quite match up, then review your calculations and go back.

The great thing about using a pay stub generator is that its calculator is FREE!

You simply have to purchase and redeem it if you’re happy with the result.