WHAT IS FORM 1099?

AND HOW TO FILE 1099'S MUCH FASTER

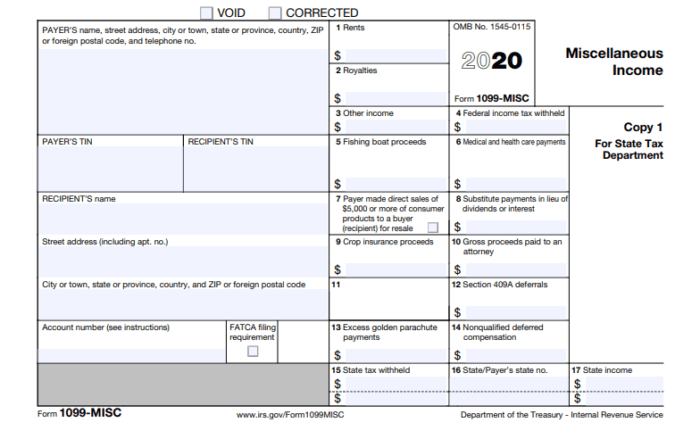

What is Form 1099? Perhaps you may have wondered what this IRS Form is used for. This is used to file Non-Employment related income.

1099's can include stocks, interests, pensions, and profit sharing.

Read more to learn how to make filing your 1099's faster.

If your miscellaneous payments exceed $600 such as payments from rentals or crop insurance, then you need to report them and file your income taxes through Form 1099.

HOW TO FILE A 1099 FORM MUCH FASTER

1. If you're an independent contractor, get 2 copies of 1099's from your client.

One copy is for your records, while the other copy is for the IRS. You need to keep your own copy in case 1099 is ever lost or damaged.

2. Proofread your 1099's.

The IRS will automatically match up the 1099s that they receive with the ones that you submitted to any of your clients. If they see a discrepancy, then they will send out an audit notice.

3. Organize your 1099's Per Year, and Per Category

Since it can be difficult to sort through all of your 1099's, it's best to organize them by year, but also by type. So if you have 1099's from different plumbers and electricians, then it helps if you organize them separately. This way when tax time comes around, you won't have any issues sorting through them quickly.

4. Keep track of your income so you don't overpay taxes.

When using your 1099's for tax time, be sure to keep track of how much money each one makes every year so that you're not overpaying taxes.

One of the best ways to track your income is through the use of an online pay stub generator.

5. Show up on time.

Show up on time. If you've been keeping track of your gross pay and your net pay, you'll be on top of taxes come tax season. So it's a good idea to show up early and get it over with when it's time to do the filing.

6. Write off your personal expenses.

Write off all your personal expenses, because this helps the tally in showing that you really were running a business and that whatever it is you do cannot be considered just a hobby.

7. Writing off mileage and car expenses.

If you’re self-employed, there may be times when you have to use your car for business. Mileage is probably the biggest deduction, but a percentage of the wear and tear on your vehicle from business use can also be deducted in one of two ways.

The first is to take a mileage deduction for the actual miles driven on business.

You will either need to keep a log of your trips or you can use software that tracks your mileage automatically. However, this option generally only works if you have a certain amount of miles per year.

The second way that you can deduct the wear and tear on your vehicle is by using the standard mileage rate.

This is currently 18 cents per mile and it was 20 cents before 2017. There are also some limitations in terms of what type of vehicle you can use this deduction with, but if your car qualifies then this is probably going to be the better option for most people.

If you’re going to go with the standard mileage rate, then it’s best to do so for the entire year at once and all in one shot. This will help reduce any issues with what kind of expenses can be deducted and how much you’re allowed to deduct since it will be compiled together from the start.

8. Maximize tax deductions for a house and rent.

When it comes time to file taxes as a homeowner, don’t forget about all of the costs that go into keeping up your home. While there are many possible deductions, these are likely some of the biggest ones:

There are two ways that eligible taxpayers can calculate the home-office deduction. In the simplified version, you can take $5 per square foot of your home office up to 300 square feet,

If the home office is not your principal place of business, you can also take a regular deduction. This is calculated by taking the square footage of the office divided by 9 and then multiplied by $5.

If you rent out part of your home, you can deduct between $25 and $100 per month for each room, depending on how big it is. If it’s just a den or a bathroom, then the limit is $25. If it’s a large bedroom or living room, then you can deduct up to $100 per month.

9. Deducting work-related education expenses

If you have to go back to school because your job requires new skills, then you may be able to deduct some of those work-related education costs this year. However, it’s important to note that only education costs that are related to maintaining or improving job skills can be deducted as an employee expense.

10. Outsource your Payroll if you're having a hard time.

If you're making enough passive income and it appears that you cannot get enough time every tax season or payroll period if you have a number of employees? Then maybe it's time to Outsource.

You can outsource your accounting and bookkeeping tasks or any number of administrative routines you have as long as you find the right Remote Staffing company.

KEY TAKEAWAYS IN ORGANIZING 1099'S

1099's are a big deal when filing income tax returns because they help report self-employment income, and they help determine how much money that's owed in federal income tax.

However, if things really get complicated, then maybe it's time to get organized! Start creating your own pay stubs now recording your income! This way, you can track your gross pay and account for all deductions that you're going to apply.