How to Make a Pay Stub for Self Employed

Pay stubs are crucial if you are self-employed.

Pay stubs usually only come when people are employed, you have a boss and an HR and they hand over their check stubs for you.

But self employed pay stubs are fundamentally invoices.

Pay stubs can come if you’re enlisting a payroll company and you have a set of employees so you can use them to pay yourself in a word.

However, it’s also perfectly possible to generate your own.

Recommended Reading: What are paystubs used for?

Importance of Pay Stubs for Self Employed Individuals

1. Pay stubs help you track your gross pay

Knowing your gross pay is important and depending on your status, your state, and your tax bracket, pay stubs allow you to automate your deductions relative to your gross pay as well.

2. Pay stubs help you secure government remittances

You can secure your benefits much faster if you standardize your income statements with a pay stub.

It’s a good idea to pay for healthcare and social security benefits.

It’s also good to find a pay stub with the right format so that you can include other details such as wage garnishes and 401k’s.

3. Pay stubs give you proof of income

If you wanna get a loan or purchase a car, you will need to show proof of income.

And if you want to show proof of income, you need a consistent stream of receipts to show that you’ve been getting paid.

Pay stubs are the best way thus far to show proof of income and that you’ve been earning.

Also Read: Proof of Income for Self-Employed Individuals

4. Pay stubs help you stay on top of taxes

Pay stubs can help you consolidate your income and it makes it easier to file your income tax returns.

Particularly your Form 1040 for individual tax returns and Form 1099, for wages you get which are not employment-related including rent and other residual income venues.

Also Read: How to File Taxes with Last Pay Stub

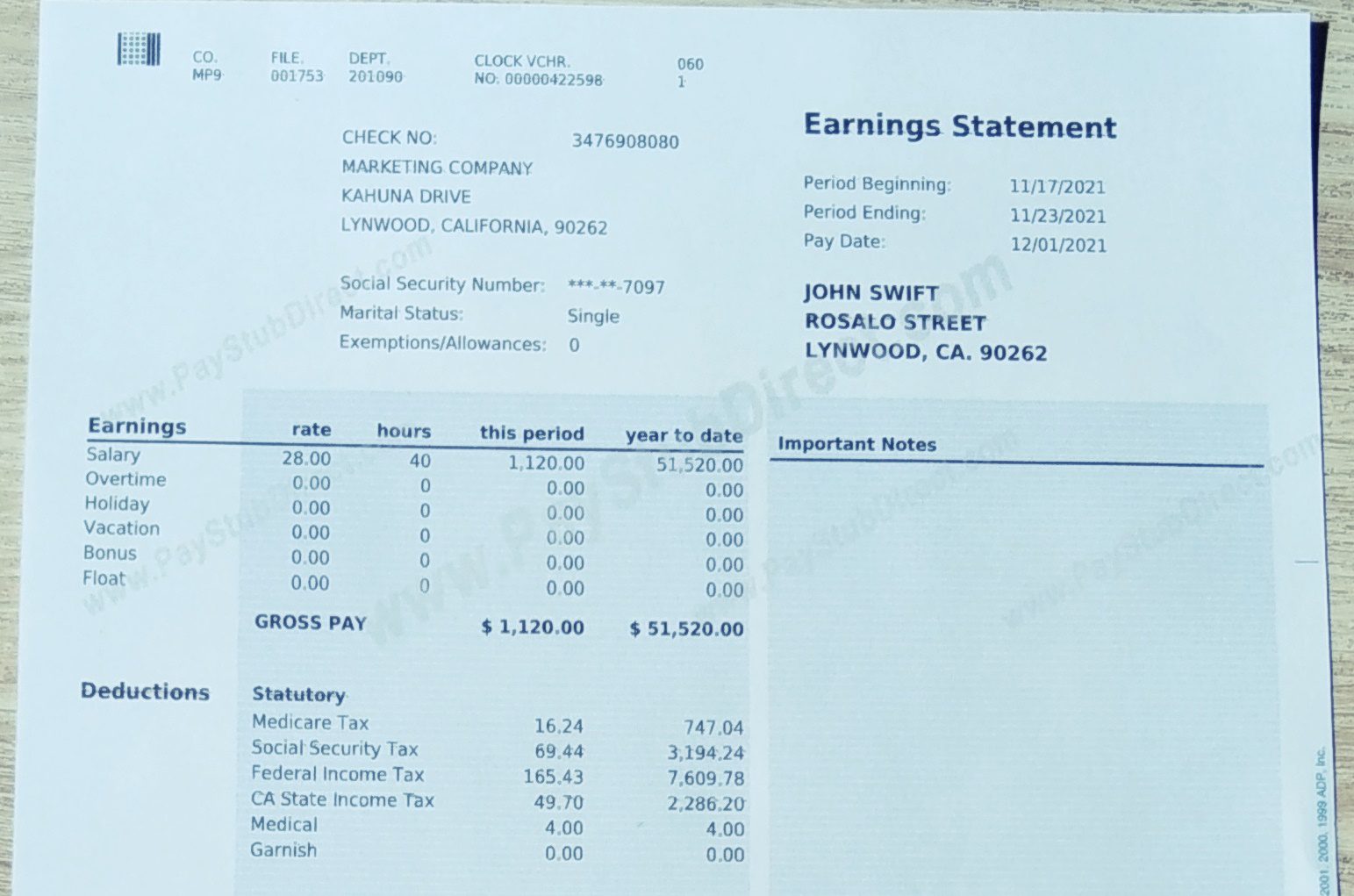

Information you Need to Create a Pay Stub

1. EIN or Employer Identification Number

If you’re already having employees under your care, you need an EIN.

You can go to the IRS website to apply for an EIN.

2. Social Security Number

If you want your remittances to work well when it’s time to make a direct deposit, then you must put your Social Security Number on your pay stubs as well.

For record-keeping purposes, you can transact online if your government numbers are all in the right place.

3. Gross Pay

The total amount you make prior to tax deductions.

4. Net Pay

The total amount you make after taxes.

5. Pay periods

You can choose between monthly, bimonthly, weekly, and biweekly.

If you are a salaried employee or a shareholder, chances are you earn high and you don’t have to get paid weekly.

Choosing monthly gives you time to account for your payments and won’t be so tedious you have to monitor your own pay periods 4 times a month.

Recommended Reading: What is a pay period?

6. Marital Status

Your tax filing status will depend on whether you’re single or married.

The great thing about an online pay stub generator though is its calculations.

Calculations are fast and automatic in an online check stub maker.

7. Commissions and Bonuses

If you’ve earned commissions and bonuses and other monies on top of your base pay, you can include them here.

If you have other payments coming to you like healthcare and child support withdrawals, you may also include them here.

You will need those amounts in filing your 1099’s.

How to Make a Pay Stub

Make your own Paystub

You can use a spreadsheet like Excel or a Word Processor like Word to make your own pay stubs.

This is the easiest way to do it and it’s free. Or you can find a free pay stub template online.

Generate a Pay Stub with a Check Stub Maker

Paystub generators online can greatly help you so you don’t have to worry about making calculations manually.

The pay stubs themselves are free to use on the go!

And if you want to remove watermarks, you simply have to Purchase.

And choose the pay stub template you like.