How to Get an EIN for Employers

Employers need an EIN or employer identification, it is paramount that you find out your EIN number. It is a unique 9 digit number which employers use if they are hiring employees for their small business.

You are going to need an employer identification number if you want to apply for a business license, open a business bank account, hire employees or file for business taxes.

You can apply for an employer identification number online, by phone or by mail. If the business is already registered with the IRS, you can find it on any notice or correspondence from the agency.

Why your Small Business Needs an EIN

Builds your business’s credit history: An EIN is similar to a social security number in that it identifies your business to creditors and others who may extend credit to your company. Your personal credit history is not affected when using an EIN at all.

The better your credit rating, the easier it will be for you to get loans and lines of credit at terms that benefit your company most.

Helps prevent fraud: Although an EIN isn’t required by businesses with no employees, getting one helps prevent fraud because it creates a unique identity for your company.

By making it more difficult for someone to commit tax fraud in your name, having an EIN protects both you and the government from illegal activity.

You can use it in lieu of a social security number on applications: When applying for business licenses and permits, applying for loans or applying for credit cards using your personal social security number puts you at risk of identity theft if any of this information is stolen or compromised in any way.

When you have an EIN, you can provide this instead of your social security number without compromising your personal information in any way. Can help reduce your tax burden: A sole proprietor without any employees will have lesser taxes to pay

What are the steps in getting an EIN?

The steps in getting an EIN are:

1) Determine your business structure.

The type of business structure you choose will affect the type of EIN you need. If you are a sole proprietor, you will need a sole proprietorship EIN. If you are a partnership, you will need a partnership EIN. If you are a corporation, you will need a corporate EIN.

2) Select the appropriate EIN application form.

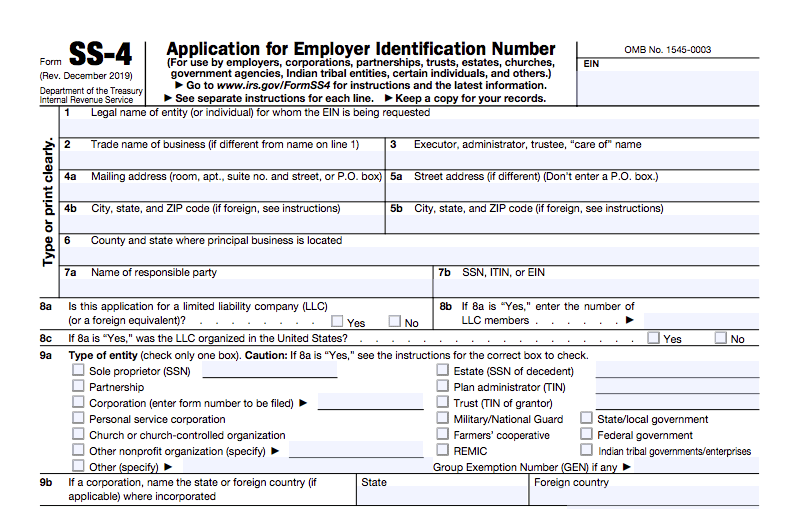

The types of EIN forms out there are three: Form SS-4, Form SS-8, and Form SS-5.

Form SS-4 is the most common type of application for an EIN. This form is used to request an EIN for any lawful purpose, including opening a business bank account or filing taxes.

Form SS-8 is used to determine whether an entity is eligible for an EIN. This form is typically used by businesses that are unsure if they qualify for an EIN.

Form SS-5 is the application for an EIN for individuals who do not have a Social Security Number (SSN).

3) Complete the EIN application form.

Fill in your EIN form and make sure the information you write is correct.

4) Submit the EIN application form to the IRS.

You can submit your EIN form to the IRS website

Create pay stubs to track your income and earnings and make pay stubs for your employees if you get your employer identification number down. Check stubs are a great way to show proof of income.