How to Spot Fake Pay Stubs

If you’re a working man or woman you know what a pay stub is.

You get them all the time.

You get them via email, or your HR prints them for you.

How to know if a pay stub is fake?

There are a couple of giveaways to know that a pay stub isn’t the real deal.

Here are some of them.

How to Recognize a Fake Pay Stub

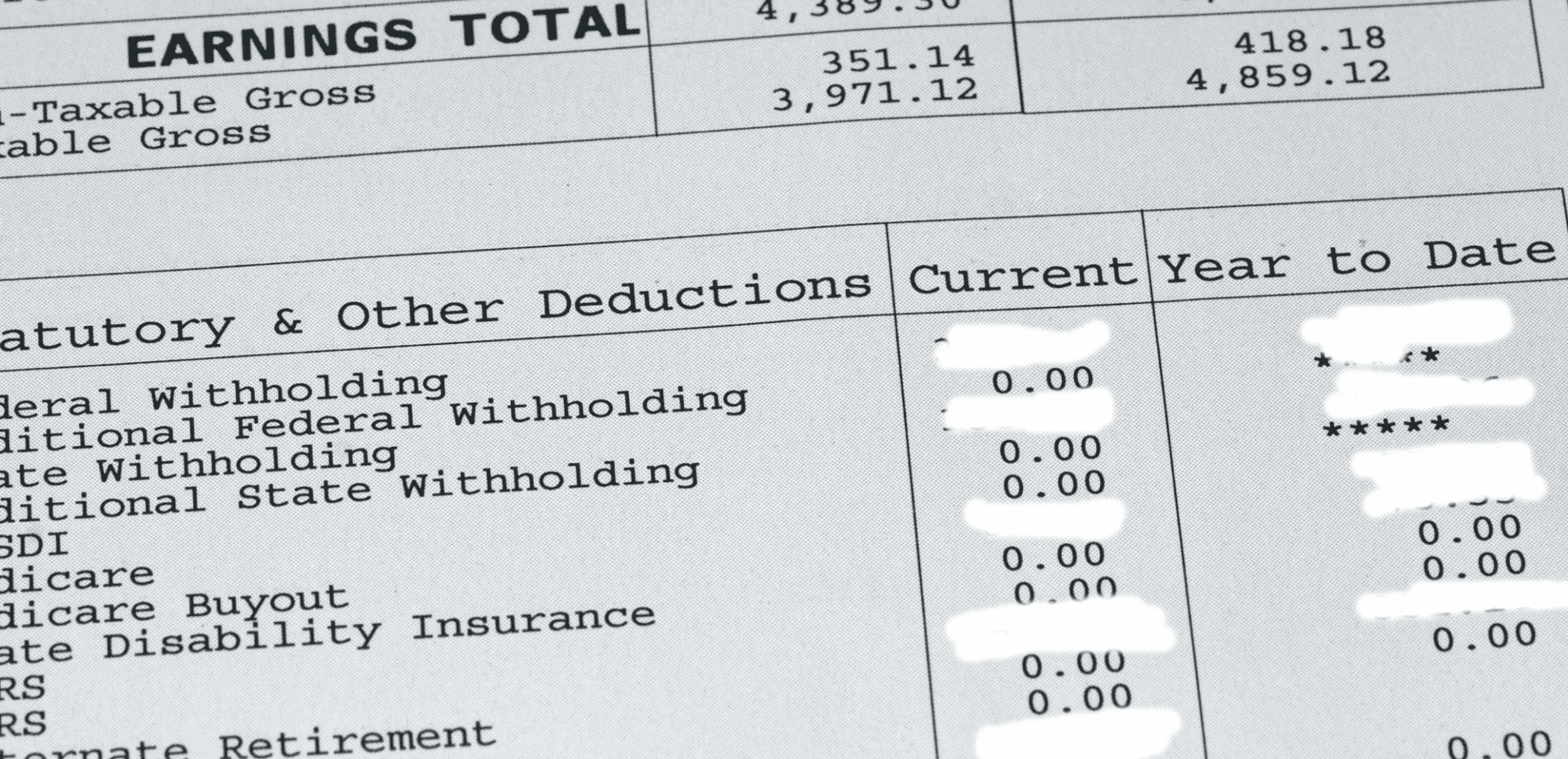

1. Missing Information

A pay stub must show the basic information including gross pay, net pay, and often full name and address.

If none of these are shown, then it must be an indication that the pay stub is forged or at least faked.

2. O’s and not 0’s.

O’s where zero’s should be is another red flag.

It’s not likely that a business or a person who’s being professional about filing his or her stub can make this mistake.

3. Round numbers

If numbers are always in the round, such as $4000 consistently, this pay stub may be faked or at least fudged and make it appear real.

If taxes are remitted, it’s not likely the $4000 will stay that way especially since state and federal taxes have specific values to them.

4. Inconsistent Information

If the information is inconsistent such as the year-to-date gross pay is lesser than the YTD net pay, then that is another red flag.

Also Read: What is YTD on a Pay Stub?

Importance of Having Authentic Pay Stubs

1. Authentic pay stubs look professional

If you’re self-employed or starting your own business, authentic pay stubs look professional.

And the fields are complete so when it comes time to file your taxes, you won’t have trouble backtracking to make changes!

2. Authentic pay stubs can be used for important transactions

If you’re going for vital transactions such as purchasing a car or renting an apartment, you don’t want to get into some fakery.

Your pay stubs have to be real or if you’re generating yourself, at least the calculations have to be accurate.

3. Pay stubs represent your employment history

If you’ve worked for a company, your pay stubs reflect that company.

If you want to show proof of income, then you need to use pay stubs from your HR or at least request and show an accurate picture of your income if you want your pay stubs to be treated legitimately.

4. The IRS Keeps Tabs on your Tax Payments - Pay stubs reflect your Tax Returns

Pay stubs and their primary uses are to calculate tax returns.

Your individual check stubs may not be inspected, sure enough, but they are the primary documents for calculating your taxes.

So if you fake them, and the IRS finds out, you may be in really huge trouble for faking them.

How to Create Real Pay Stubs

1. Online Pay Stub Generator

You can use an online pay stub generator.

The calculations are free!

Purchase if you like the format and you wanna remove watermarks.

But the great thing about online pay stubs is that they reflect taxes and remittances automatically!

It’s hassle-free, all you have to do is fill in your information.

2. Get a Free Pay Stub Template

Get a free pay stub template online and fill it in.

Templates don’t have auto calculations so you need to make sure your math is very accurate.

In any case, your pay stubs or check stubs are going to reflect your income for a given period.

Take great care in creating them.

Get Started Now

Need a paystub? Create one now and use it for whatever legal purpose you need it for.