Are you looking for a free paystub generator? That’s a good thing, especially if you don’t have the time to manually input the salary and compensation of your workers.

You can go for an online paystub generator provider and use quality pay slips to keep your employees informed and transparent about the compensation and benefits going their way.

This allows you a lot freedom so you don’t have to worry about manually encoding them.

But here are some of the fundamental inclusions:

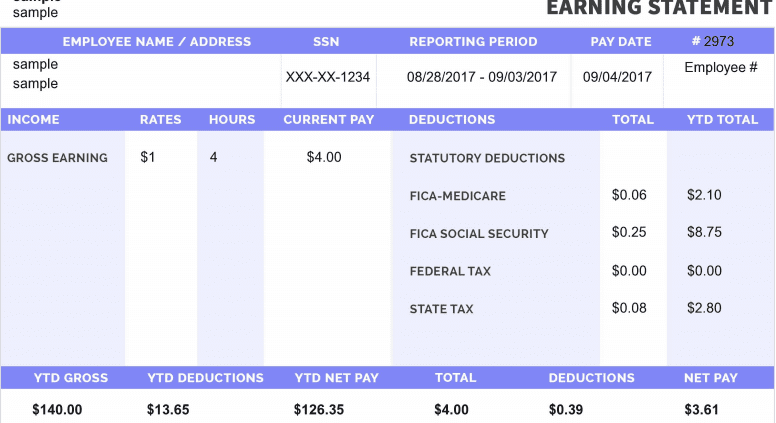

Gross wages

These are the total earnings of an employee at any given time. A good paystub generator is something that allows you to create these as part of the whole package. Make sure you also understand the pay grade of all your workers so you don’t get confused about those additions.

Deductions

These are for uniform fees and other wage remittances. Make sure that you outline what these deductions are so you can use your paystub and know where to place each of the individual terms. An online template will make it easy for you to use.

Taxes

It’s important that you include these as separate lines including federal taxes and state taxes. And if required, unemployment taxes. Many of these online slips have a good outline on how to differentiate these different stub templates. In any case, professional templates require you to account for all of these.

Stick with Compliance

If you want to be the person who encodes all of these figures, then use legitimacy as much as possible. Don’t exaggerate nor detract from your earnings. You should stay compliant with your state laws and regulations and this is how you can operate efficiently in the long run.

Write all of your requirements

If you want to use a free pay slip generator, you need to list down all of the functions and forms you have in advance first. It’s also important to memorize the pay periods for each employee. If you are a small company, it might be ideal if you all have the same salary payouts.

Net Pay

This is the sum total of your employee’s pay after you have accounted for all his their deductions. You need to make sure you input the right amounts and figures in the first steps in order to ensure an accurate net pay.

Your free generator ought to be able to do that and then you can decide if this online provide is something you want to subscribe to. Additionally, there are some things you can do online to make your life easier.

Several of the tips that you can use when it comes time for payroll is to have an Accounting system of your own. You can use Google Sheets or you can work offline and export them to the cloud.

Another important aspect in encoding your online paystubs is to get to know your employees personally, if you can. If you are still a small enterprise, it makes sense to be up close and personal with your workers. You can use these online tools properly so you can have an enhanced workflow. This allows you much more flexibility so you can focus on your core tasks.

It’s good to use free tools once in awhile, but if you’ve decided having a specific format for a pay slip generator is ideal, then you can subscribe and start enhancing your payroll routine.

GET YOUR FREE ONLINE PAYSTUB NOW