How to File Schedule C - Is it Part of Form 1040

What is Schedule C?

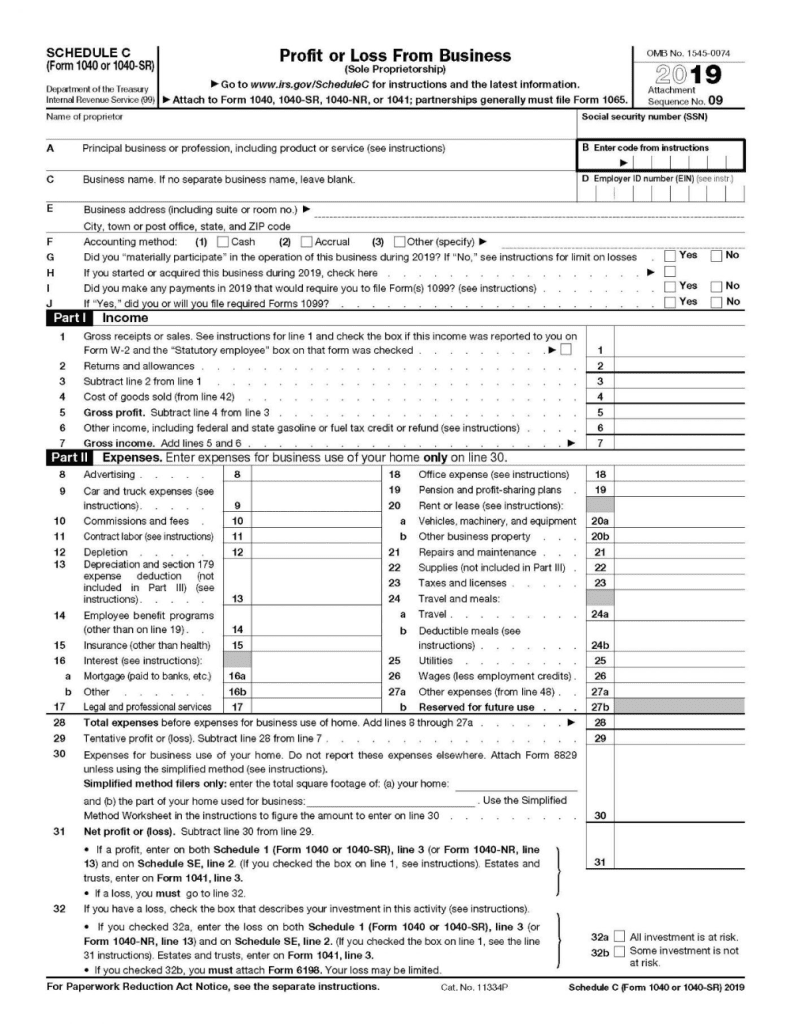

Schedule C is a part of Form 1040. Small business owners who are sole proprietors use it to show how much their profits are losses are for a year. The IRS then uses the information on Schedule C for calculations on taxable income.

This is also the form used for assessing taxes or refunds.

It’s used by sole proprietors to let the IRS know how much their business made or lost in the last year. The IRS uses the information in Schedule C to calculate how much taxable profit you made—and assess any taxes or refunds owing.

Who Has to File a Schedule C?

If you are a sole proprietor you will need to file this form. You will also need separate ones for each business you have.

Here are some of the guidelines for sole proprietors who must file Form 1040 - Schedule C.

- Your business it not a corporation or partnership

- You don't have a manager or a boss who must withhold your salary

- Your business is for profit

- You conduct businesses on a regular basis, and your work is not a hobby

- You are a single member of an LLC which is not an S corporation

What You Need for Filing Schedule C

- The IRS’s instructions for Schedule C

- Your SSN (Social Security Number)

- Your EIN (Employer Identification Number)—if you have one

- Income statement

- Balance sheet

- Receipts or statements for any business purchases—including food expenses, and big-ticket items like equipment, cars, or buildings

- An inventory count and valuation (if you sell products)

- Mileage records

How to Fill in Schedule C

The top sections of Schedule C are ordered numerically but we can focus on the boxes which Schedule C requires you to fill in:

A-B: in box A, put a description of your business type and the relevant code - which the IRS instructions will give you.

F: Put your accounting method. Typically small business owners use cash accounting. If you have an accounting and bookkeeping partner, you can ask them what methods they use for your filing.

G: "Material participation" is asking you if you worked in your business. If you are not sure, make sure you clarify that with an attorney.

H: First year in business, this box must be checked.

I-J: If you paid subcontractors or individuals $600 or more for work in your business, you’ll need to file Form 1099.

If you check yes to I you must say yes to J.

Social Security Number (SSN): You must enter your SSN, even if you use an EIN for business purposes. If you do use an EIN, enter it in Box D.

Part 1 - Income

Line 1: Enter your business name and address

Line 2: Enter the type of business you run. For example, if you are an accountant, on this line you would write "accounting."

Line 3: If you have a business partner, enter their name and Social Security number here. If you are the sole proprietor of your business, just leave this line blank.

Line 4: Check the appropriate box to indicate whether your principal business activity is manufacturing, merchandising, service, or something else.

Line 5: Enter the code for your principal business activity. You can find a list of codes in the instructions for Schedule C.

Line 6: If you have more than one business, use this line to tell us which business this Schedule C is for. For example, if you have a bakery and a bookstore, and this Schedule C is for the bakery, you would write "bakery" here.

Part 2 Expenses

Line 9: Car and truck expenses – here you have the option to deduct the actual expenses of using your car for business or you may take deductions for standard mileage.

Line 11: Contract labor, these are payments made to independent contractors for services which you provide. Never include any wages paid to employees which you report on Form W-2.

Line 12: Depletion – This is only used by companies who own natural resources.

Line 13: Deprecation – This is included to recover the cost of equipment or properties which are still in circulation after the given tax year. You can check out IRS publication 946 to learn more about this.

Line 18: Office expenses

These are for office supplies and postage expenses. If you work at a home office, you may need to check Line 30, not 18.

Line 30 – Expenses for the business use of your home

Most freelancers work from home. This means that a part of your household bills can be claimed as business expenses. The IRS have clear guidelines on what includes a home office. So make sure to read sections C-9 through C-13 to qualify.

Part 3 – Cost of Goods Sold

If you are a salesperson or subcontract, you need to fill in Part 3. This section is very convenient to fill in.

Line 33 might be tricky. This is where you’re tasked to explain your inventory. Most small businesses use the Cost method or cost of purchase. If you’re using cash accounting however, the only way to value your inventory is through this method. If you compare the price you paid with it’s specific market value.

You can also use lower of cost or market, where you compare the price with the market value and you check the valuation date each year. This method though, is far more complicated.

Part 4 – Information on your Vehicle

If you’re claiming expenses on a truck or car in Line 9, then you must fill in Part 4. You need mileage records if you want to successfully make this claim.

Make sure that you record information that is accurate.

Part 5 – Other Expenses

This section is for any expenses you have henceforth not reported. Check Lines 8-26 or Line 30. Remember to go back to Line 27a and enter those corresponding lines and anything in Part 5.

How to Speed Up your Schedule C Filing

Schedule C is to be filed on April 18 of the 2022 tax season. In order to make sure you speed up the filing of Form 1040 schedule C, you must adhere to the following guidelines:

1. Have 2 Separate ATMs

It’s important to have separate accounts for your personal home finances and those for your income. It’s great to keep these separate because you can separate personal spending from business-related expenses. A great start then is to have separate bank accounts for your business.

2. Keep track of your profits and expenses

Make sure to record your profits and your expenses. Every time you spend, especially if it is related to business, including car mileage or eating at restaurants if you’re meeting with clients can become tax-deductible. So being able to track these will help you with your tax filing.

Read - How to File Taxes as a Freelancer

3. Prepare your Schedule C ahead of time

Don’t wait until it’s already tax season. Get your Form 1040s ready. For that matter, get your 1099’s ready if you have non-employee income from your working gigs. Staying ahead of things makes sure that you can achieve these remittances without worrying about the hassle of actual tax filing.

4. Create a pay stub and track your income

Create a pay stub every time you receive payments. You can use them as invoices. If you have 2 bank accounts, you can create a pay stub every time you pay yourself your own salary. This makes it easier to track and it becomes easier to separate your gross and net pay.

Your Form 1040 Schedule C requires a meticulous amount of detail, however, if you’re familiar with the ins and outs of your finances, filing your Schedule C should be a walk in the park.

Create a pay stub now and stay on top of tax season and your Schedule C.

People Also Ask

Do I need to file a Schedule C if I had no business income?

If you have no income, then, NO, it's not needed for a Scheudle C (Form 1040) for that year.

How much can I make without pay taxes?

For 2022, the maximum income threshold is$330,800 for married couples filing jointly and $165,900 for single filers. You can take a pass-through deduction of up to 20% of your qualified business income if your income is within these limits, based on your filing status.