W4 vs. W2 - The Differences and How to File

What is Form W-4?

W-4 is also known as the employee’s withholding allowance certificate.

It shows how much income taxes to withhold from an employee’s pay.

Employees must complete their W-4 if they are new hires in a given company.

It is typically completed on their first day or prior to their first pay period.

Once you finish W-4 your employer then uses that information to calculate your federal taxes.

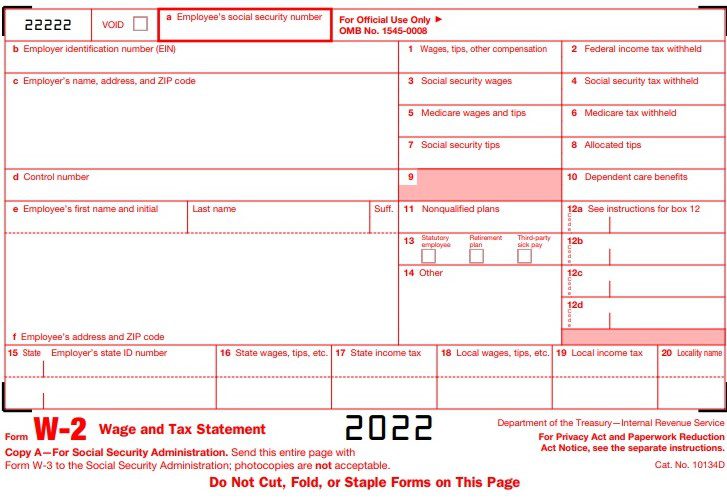

What is Form W-2?

The W-2 form is used for wages and taxes.

Employers create this annually for all of their employees.

W-2’s show the gross earnings of an employee.

And it also includes deductions for their income.

This may include Social Security or Medicare taxes and it may also include child care account contributions including remittances which are created for retirement.

Employees need their W-2 forms to file their personal tax returns.

You can file them electronically or manually.

And if you do them manually, you can submit them to the Social Security Administration (SSA).

Who completes the Forms?

W-4 is filled in by employees

Employees fill in this form.

Employees put in their personal information and withhold allowances on the W-4.

If you are an employer, you need to fill out sections of the W-4 if you’re using it to fulfill requirements for new hires.

W-2 is filled in by employers

The employers fill these out using W-2 payroll data for the tax year.

Employers complete the W-2 for each employee.

When to complete W-4 vs W-2?

W-4 is completed at the start of the hiring process

Employees should fill out the W-4 at the beginning of an employee’s onboarding process.

The W-4 determines how much is the withholding tax per the employee’s paycheck.

And employees fill in their W-4 prior to their first pay period.

Employees can fill out a new W-4 if their personal or financial situation changes thus meriting a need to change or adjust their withholding taxes.

W-2 is for income tax returns every January

Employers file a W-2 for every employee every year, prior to January 31.

The W-2 showcases the data from the previous tax year.

A W-2 which is filed in January 2022 is going to reflect the payroll periods in 2021.

How to File Forms W-4 and W-2?

W-4 is sent to the IRS or Social Security Administration

Your employee fills out the W-4, it must then be filed electronically or physically, but you need to send it to the IRS or Social Security Administration.

What you have to do is file a W-4 form if you use it to meet the new-hire requirements which the state requires you to input as well.

W-2's are given to employees and they send it to the Social Security Administration

W2’s are submitted to the social security administration through mail or digital.

Additionally, employers are tasked with handing out their completed W-2 forms to all their employees each year.

It’s better if you’re an employer to give it to your employers prior to Jan. 31.

How to File W-4's and W-2's much Faster

Get an HR to file your W-4’s and W-2’s

It makes sense to hire an HR person if you’re too busy to file them yourself.

Getting an HR or outsourced payroll gives you the chance to move faster without having to worry about missing out on your regular chores.

Make sure to create a checklist for HR

If you want to retain their information for their W-4’s then tell your HR to ensure that there is a checklist.

You must also require your employees to fill this in prior to their first pay periods.

Check your state laws and taxes

Filing your taxes is important.

The more mindful you are about your returns, then it’s likely you’re going to integrate these with your employees’ payments.

So make sure to stay on top of taxes.

Create a pay stub using a pay stub generator online

Online pay stub generators can give you leverage because of your auto calculations.

In fact, we have an online W-2 generator together with our check stub makers because we want to make sure your pay stubs are as error-free as possible.

Emailing them to your employees or printing them out then becomes much faster.