What Happens if You Don't File a W-2 Statement?

What happens if you don’t file a W-2?

The truth is most Americans aren’t conscious about paying taxes.

Even if many Americans and others worldwide think about starting their own businesses.

Have you generally felt that tax season is daunting?

Then you can simply manage it into more organizable tidbits.

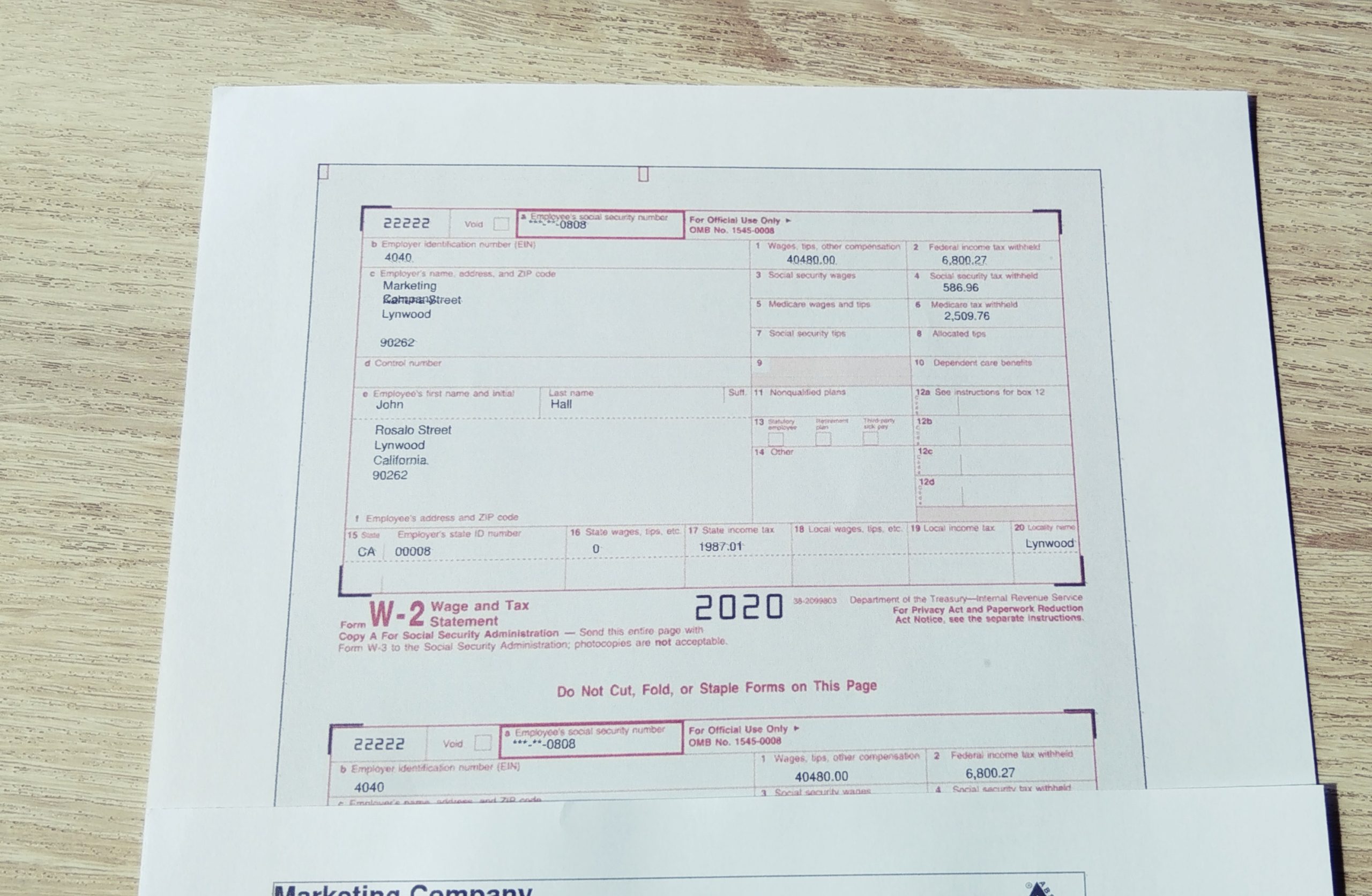

This is where you track your wages and then reconcile them onto your W2 forms every tax year.

What Happens if you Fail to File a W2

There are times that it gets so tedious that attending to taxes can be a burden.

IRS enforces their rules.

Even if you forget to file your W2’s, you will still get your returns but there often can be late fees or notices.

In short, you will need to pay more than what you originally had to if you don't file your W-2's on time.

Will there be Penalties if you Fail to File W2?

1. The IRS may charge you a penalty for filing your taxes late.

This is usually 5% of the amount you owe for every month your taxes are late, up to a maximum of 25%.

2. You may not be able to claim certain tax deductions or credits if you don't file your W-2's on time.

What would have been rebates or money savings are now wasted because of your errant filing.

Getting to your W-2’s on time or asking them from your employer makes certain that you don’t have to fall into this trap.

3. You may have to pay interest on any taxes you owe.

The interest rate is currently 3% per year.

This is something you can avoid.

4. The IRS can make you pay penalties + interest.

This is the worst of the penalties and it can skyrocket or overhead costs if you have to deal with these payments.

How PayStubDirect Can Help You

If you don’t have an W2 it’s high time you call your employer and ask them to release your W2 forms.

If your employer is uncooperative, you may call the IRS and ask them for help.

If you must track your W2 wages yourself, then it’s time you can create a Paystub so that you can independently track and account for all of your remittances and payments in the past year.

Also Read: How to calculate W2 wages from a pay stub.