Free Wisconsin Payroll Calculator

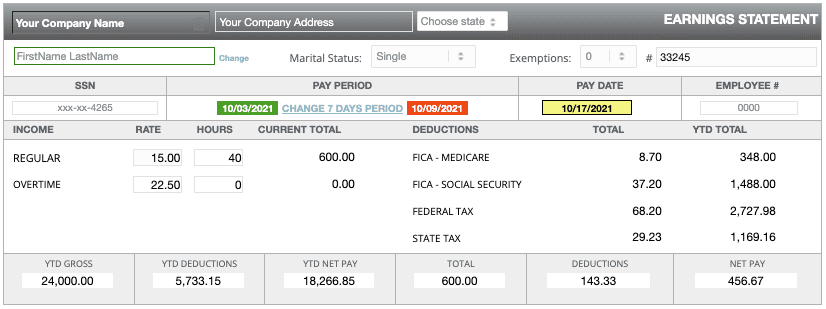

Payroll calculations are frequent and often a hassle. If you want to generate your own payroll checks or check stubs, you can make them on your own. Often though, regular pay stub templates are not built with a calculator.

This is when a Wisconsin Paycheck Calculator can come in handy.

What is a Wisconsin Paycheck Calculator?

A Wisconsin paycheck calculator is also an online pay stub generator, it helps you fill in your salary and earnings to help you calculate your gross pay and your net pay.

An online Wisconsin paycheck calculator also lets you choose your payment intervals whether that’s hourly, weekly, biweekly, or bimonthly.

Small businesses in Wisconsin are generally the type which are classified as small, and they are also the backbone of the state’s economy.

These businesses are responsible for creating a majority of the jobs in the state, and they also tend to have a higher rate of job creation.

What information is needed on a Wisconsin Paycheck Calculator?

Full Name

Enter your full name and make sure to Enter your State and City

Marital Status

If you are married and filing separately, you must both file returns, even if one of you did not earn any income in Wisconsin.

Pay Period

In our online pay stubs, you can choose the payment periods in the calendar fast and easy. If you’re paid weekly, then choose the weekly option.

FICA Medicare

FICA Medicare in Wisconsin is typically cheaper than in most other states.

The average monthly premium for a Medicare Part D plan in Wisconsin is $31, which is lower than the national average of $41.

Additionally, the average monthly premium for a Medicare Advantage plan in Wisconsin is $32, which is also lower than the national average of $37.

You don’t have to worry about all this though in using your online Wisconsin pay stub generator since it performs all the calculations for you.

FICA Social Security

FICA Social Security in Wisconsin is also typically cheaper than in most other states. The average Social Security benefit in Wisconsin is $1,169 per month, which is lower than the national average of $1,230.

Additionally, the maximum monthly Social Security benefit in Wisconsin is $2,687, while the national maximum monthly benefit is $2,788.

You won’t have to pay as much though because for example if you’re earning $20 for a 40-hour workweek you’ll only remit $49 from your $800 paycheck.

It can seem a bit daunting by hand, but your Wisconsin paycheck calculator can ensure faster calculations.

State Tax

Wisconsin state taxes are paid every year on April 15.

Wisconsin state income tax is a graduated tax, which means that the percentage of tax owed increases as income increases.

The first $11,770 of taxable income is taxed at 4%,

the next $23,540 is taxed at 5.84%,

the next $47,080 is taxed at 7.65%,

and any income over $77,640 is taxed at 8.97%.

There are also a number of deductions and credits that can be claimed to reduce the amount of tax owed.

For example, there is a deduction for income earned from pensions and social security, and a credit for property taxes paid.

Federal Tax

Here is a rough guide on Wisconsin Federal Tax

Single:

$0 – $9,325 = 3.6%

$9,326 – $37,950 = $340.90 plus 5.84% of amount over $9,325

$37,951 – $91,900 = $2,062.90 plus 7.65% of amount over $37,950

$91,901 – $191,650 = $4,749.90 plus 11.4% of amount over $91,900

$191,651 and above = $13,089.90 plus 16% of amount over $191,650

Married Filing Jointly:

$0 – $18,650 = 3.6%

$18,651 – $75,300 = $340.90 plus 5.84% of amount over $18,650

$75,301 – $151,900 = $2,062.90 plus 7.65% of amount over $75,300

$151,901 – $233,350 = $4,749.90 plus 11.4% of amount over $151,900

$233,351 and above = $13,089.90 plus 16% of amount over $233,350

Head of Household:

$0 – $12,750 = 3.6%

$12,751 – $50,400 = 340.90 plus 5.84% of amount over 12750

$50401-130200= 2162 90plus 7 65 percent of amount over 50 400

130201-216950= 4 749 90plus 11 4 percent of amount over 130 200

216951 and above= 13 089 90plus 16 percent of amount over 216 950

What Else can I do to File my Taxes Faster?

Generate a pay stub online

An online pay stub generator can help you make calculations faster and if you’re self employed, you can use it as your personal invoice to pay yourself. It’s also great to stay on top of taxes so that you won’t have to be subject to some IRS penalties.

File your W-4’s right away

If you have new hires, then get them to file their W-4’s or if you’ve had a new job, fill in your W-4’s properly. This is an important step in making sure that your income tax returns will be accounted for.

Stay on top of taxes

Keep track of your taxes and payments. If you want, you can pay your employees weekly and make sure you commit to certain periods in the month to pay off their monthly taxes and their government payments.

Check your pay stub for net pay

Learning about your net pay and how much your take home pay over time will help you understand how you’ve been faring with your earnings. Stay on budget and live within your means. It’s a great idea to use your pay stubs to track your income so that when it comes time to pay your government dues and taxes, things get easier.