UPLOAD LOGO

EDIT LOGO

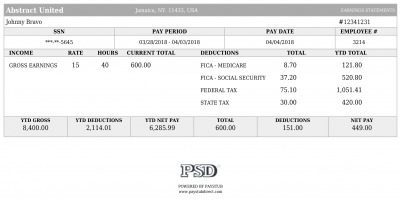

EASY PAY STUB STYLE

Style:

Easy

Hired Date

Pay Start

Pay Frequency

Pay End

Pay Date

Stub Shown

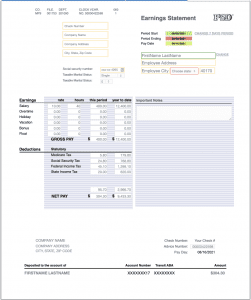

Modify Stub

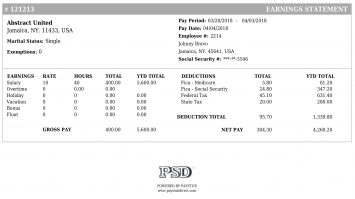

Stub Style

Pay Frequency

Available Periods

Select Which Stubs to Buy (Blue Check)